Empowering Futures: Teaching Kids Financial Literacy

Financial literacy is a crucial life skill, and instilling it in children from an early age sets the foundation for a secure and empowered future. This article explores the importance of teaching kids about finances and offers insights into effective strategies for financial education.

The Significance of Early Financial Education:

Introducing financial concepts to children at a young age is essential for their long-term financial well-being. Early education helps cultivate a positive attitude towards money, encourages responsible financial behavior, and equips kids with the tools they need to make informed financial decisions as they grow.

Making Learning Fun with Age-Appropriate Activities:

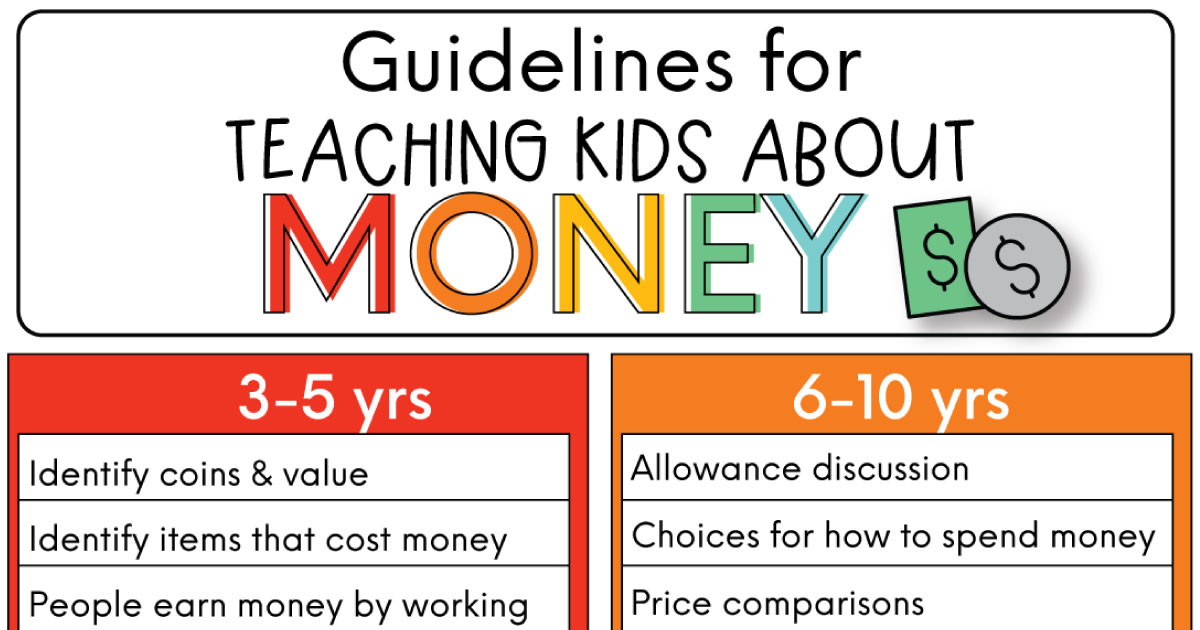

Engaging kids in financial education can be enjoyable and interactive. Utilize age-appropriate activities to make learning about money fun. Board games, role-playing scenarios, and interactive apps can teach valuable lessons about budgeting, saving, and the importance of making wise financial choices.

Teaching Budgeting and Saving Skills:

Teaching kids about budgeting and saving is a fundamental aspect of financial literacy. Introduce the concept of budgeting by allocating a portion of their allowance or gift money to different categories such as saving, spending, and sharing. This instills a sense of financial responsibility and helps them understand the value of money.

Introducing Basic Banking Concepts:

Introduce kids to basic banking concepts to familiarize them with financial institutions. Explain the purpose of banks, how savings accounts work, and the importance of earning interest. As they become accustomed to these concepts, they will develop a greater understanding of the banking system.

Setting Financial Goals and Rewards:

Encourage kids to set financial goals and attach rewards to their achievements. Whether it’s saving for a special toy or planning for a future purchase, goal-setting instills discipline and determination. Celebrate their successes, and this positive reinforcement reinforces the connection between financial responsibility and personal fulfillment.

Teaching the Value of Earning:

Teach kids the value of earning money through age-appropriate chores or entrepreneurial ventures. By earning their money, children develop a stronger appreciation for the effort and time it takes to generate income. This foundational understanding sets the stage for a healthy work ethic in the future.

Discussing Wise Spending Habits:

Guide children in developing wise spending habits. Encourage them to think critically before making purchases, differentiating between needs and wants. Teaching the concept of delayed gratification helps instill patience and a thoughtful approach to spending.

Exploring the Concept of Credit:

As kids mature, introduce them to the concept of credit in a simplified manner. Explain the idea that credit involves borrowing money and the importance of repaying borrowed funds responsibly. Emphasize the long-term impact of credit decisions on their financial well-being.

Encouraging Entrepreneurial Thinking:

Foster entrepreneurial thinking by encouraging creativity and resourcefulness. Engage kids in activities that stimulate their entrepreneurial spirit, whether it’s organizing a small business venture, creating handmade crafts to sell, or developing innovative solutions to common problems. This not only nurtures creativity but also teaches valuable lessons about enterprise and financial independence.

Leading by Example:

Children often learn by observing their parents or guardians. Demonstrate positive financial behaviors and attitudes by being transparent about financial decisions, discussing the family budget, and showcasing responsible financial practices. Creating an open dialogue about money fosters a healthy financial mindset.

In conclusion, teaching kids about finances is an investment in their future well-being. By imparting essential financial skills and values early on, we empower the next generation to navigate the complexities of the financial world with confidence. To explore more insights on Teaching Kids Finances, visit this link for additional information and resources.