Empowering Kids Financially: Essential Money Lessons

In a world driven by financial transactions, imparting money lessons to children is a valuable investment in their future. Teaching kids about money not only equips them with practical skills but also instills a sense of responsibility and financial literacy from a young age.

Start Early: Building Financial Foundations

The journey of teaching kids about money should commence early. Introduce basic concepts like saving, spending, and sharing money as soon as children are old enough to understand. Simple activities like using piggy banks or creating a savings jar can make financial lessons engaging and age-appropriate.

Practical Money Management: Allowance and Budgeting

Introducing an allowance system can be an effective way to teach kids about money management. Encourage them to allocate funds for different purposes, such as saving for goals, spending on treats, and setting aside money for charity. This hands-on experience lays the foundation for budgeting skills later in life.

Saving for Goals: Cultivating Financial Discipline

Teaching kids to set and save for goals fosters financial discipline. Whether it’s saving for a toy, a gadget, or an experience, the concept of delayed gratification becomes tangible. This practice instills patience and resilience, valuable qualities in navigating financial challenges in adulthood.

Earning Money: Instilling a Work Ethic

Introduce the idea of earning money through age-appropriate tasks or chores. This not only teaches kids the value of hard work but also helps them understand the connection between effort and financial reward. It instills a work ethic that will benefit them in their future endeavors.

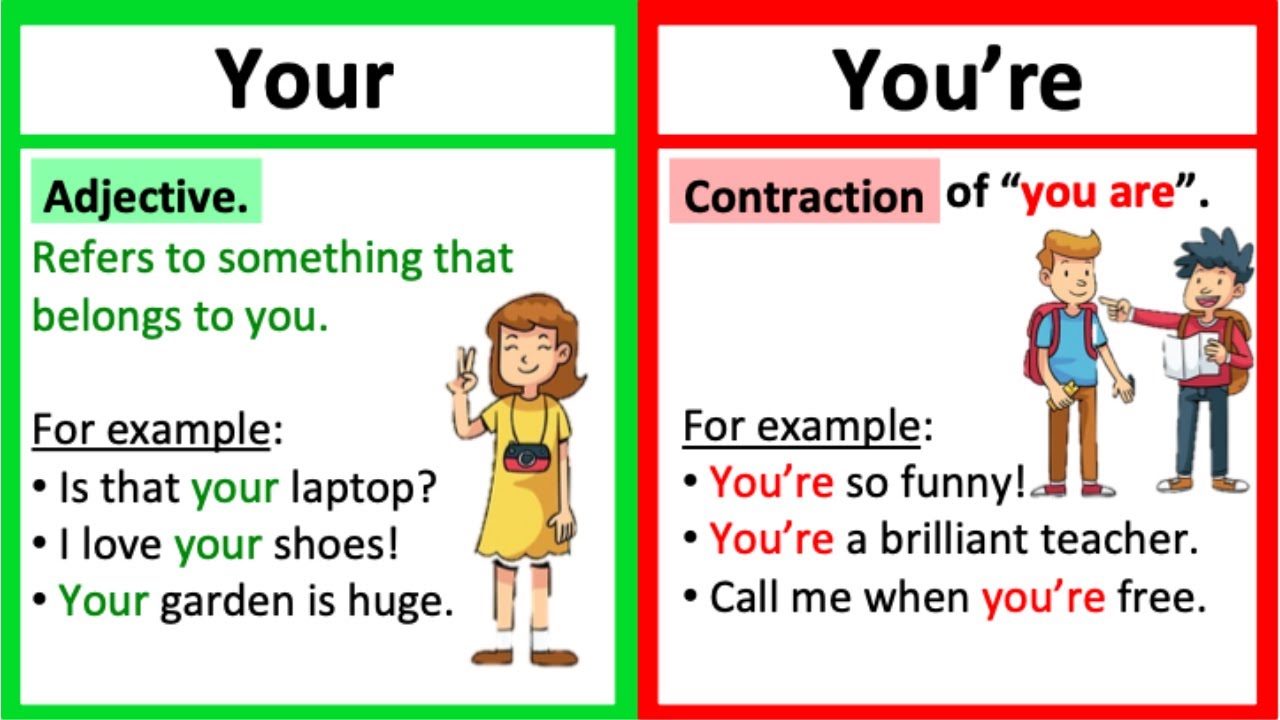

Smart Spending: Differentiating Needs from Wants

Teaching kids the difference between needs and wants is a crucial money lesson. Engage them in discussions about prioritizing purchases and making conscious spending decisions. This understanding lays the groundwork for responsible financial choices as they grow older.

Banking Basics: Introduction to Financial Institutions

Introduce the concept of banks and financial institutions to children. Explain the purpose of savings accounts and how interest works. This foundational knowledge sets the stage for more advanced financial concepts and helps kids become comfortable with the banking system.

Learning from Mistakes: Money as a Tool for Growth

Encourage a healthy attitude toward mistakes in money management. When kids make spending errors, view them as learning opportunities. Discuss what went wrong and how they can make better choices in the future. This approach helps them develop resilience and problem-solving skills.

Teaching the Value of Giving: Charity and Generosity

Incorporate lessons about the value of giving back to the community. Whether through donating a portion of their allowance or volunteering time, teaching kids about charity fosters empathy and a sense of responsibility towards others. It instills the importance of making a positive impact on the world.

Modeling Healthy Financial Behavior: Leading by Example

Children often learn best by observing the behaviors of those around them. Model healthy financial habits, such as budgeting, saving, and making thoughtful spending decisions. Your actions serve as powerful lessons, reinforcing the importance of responsible financial practices.

Empowering the Future: Resources for Ongoing Learning

To delve deeper into teaching kids about money, explore resources that offer age-appropriate financial education materials. Utilize books, games, and online platforms that make learning about money engaging and interactive. This ongoing education empowers kids with the knowledge and skills needed for financial success.

To explore more tips and resources on Teaching Kids Money, visit alnewgetinfo.my.id. Empower your children with essential money lessons, setting the stage for a financially savvy and responsible future. visit https://dilectus.my.id/