Navigating the US Inflation Landscape for Economic Stability

The United States is currently grappling with an inflationary environment that requires careful consideration and strategic planning. In this article, we explore the factors contributing to inflation, its impacts on various sectors, and effective strategies for individuals and businesses to navigate and maintain economic stability.

Understanding Inflationary Pressures

At the heart of the challenge is understanding the factors contributing to inflationary pressures. These may include increased demand for goods and services, supply chain disruptions, and rising production costs. A comprehensive understanding of these elements is essential for policymakers and businesses to formulate effective strategies to address the root causes of inflation.

Consumer Impact: Adjusting Spending Habits

Inflation has a direct impact on consumers as the cost of goods and services rises. This often leads to adjustments in spending habits, with individuals prioritizing essential purchases. Businesses need to adapt their marketing and pricing strategies to align with consumer behavior in this inflationary environment, where affordability becomes a significant consideration.

Business Strategies: Adapting to Rising Costs

Businesses operating in an inflationary environment face the challenge of managing rising costs. Increased costs of raw materials, transportation, and labor can squeeze profit margins. Crafting effective pricing strategies that balance the need for revenue generation with consumer affordability becomes essential for the sustained success of businesses.

Investment Considerations: Navigating Inflation

Investors need to reconsider their investment strategies in response to an inflationary environment. Certain asset classes, such as real assets (real estate and commodities), historically perform well during inflationary periods. Diversifying investment portfolios and exploring inflation-protected securities can be prudent strategies to hedge against the eroding impact of inflation on the value of money.

Linking to Informed Decisions: US Inflationary Environment

To gain deeper insights into navigating the US inflationary environment effectively, visit US Inflationary Environment. This resource provides comprehensive information and analysis, offering a closer look at key factors, trends, and opportunities in the face of inflationary pressures.

Government Policies: Balancing Act for Economic Stability

Government policies play a pivotal role in managing inflation through monetary policy. Adjusting interest rates and implementing other measures are tools governments use to control inflation. However, finding the right balance is a challenging task. Tightening monetary policy too aggressively may stifle economic growth, while being too accommodative may exacerbate inflationary pressures.

Real Estate Dynamics: Impact on Housing Market

The real estate market is significantly influenced by inflation. While property values may rise, the cost of borrowing and construction can also increase. Homebuyers and investors need to carefully evaluate market conditions and consider locking in favorable financing terms. In an inflationary environment, real estate decisions should be driven by a comprehensive understanding of both short-term and long-term economic trends.

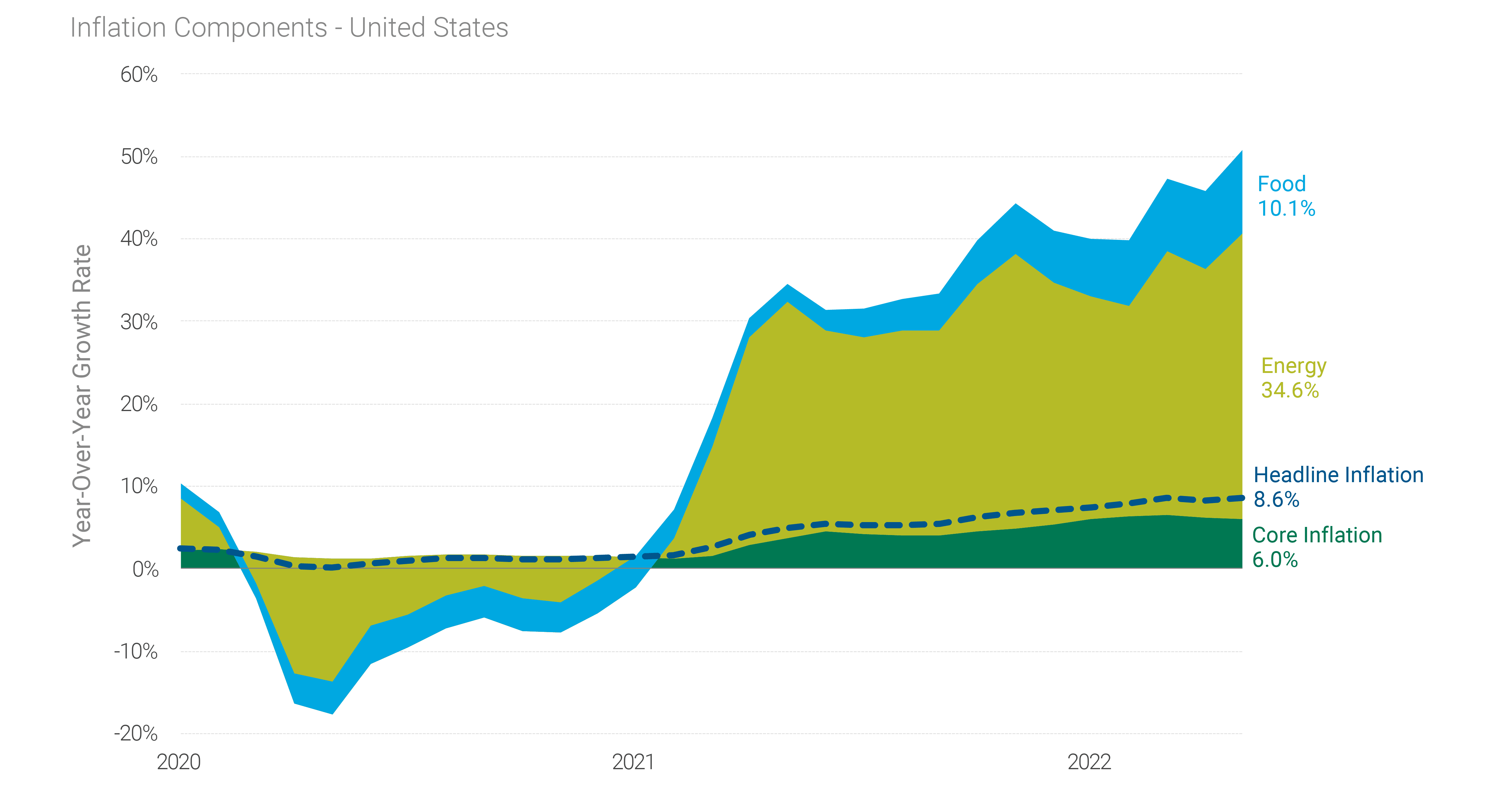

Consumer Price Index (CPI) and Economic Indicators

Monitoring key economic indicators, such as the Consumer Price Index (CPI), is essential for assessing the severity of inflation. The CPI reflects changes in the prices paid by consumers for goods and services over time. Understanding these indicators provides valuable insights into inflation trends, helping individuals and businesses make informed financial decisions.

Adapting Financial Planning Strategies

Individuals and businesses alike must adapt their financial planning strategies in response to an inflationary environment. This may involve revisiting budgetary allocations, exploring alternative investment opportunities, and considering inflation-protected financial instruments. Proactive financial planning is essential for mitigating the impact of inflation on long-term financial goals.

The Road Ahead: Striving for Economic Stability

In conclusion, navigating the US inflationary environment requires a proactive and informed approach. From understanding the root causes of inflation to implementing adaptive investment and financial planning strategies, individuals and businesses can build resilience in the face of economic challenges. Staying informed and making strategic decisions will be key to weathering the current economic landscape and striving for economic stability.

.jpg)