Analyzing Inflation Rates: Insights into Economic Trends

Introduction

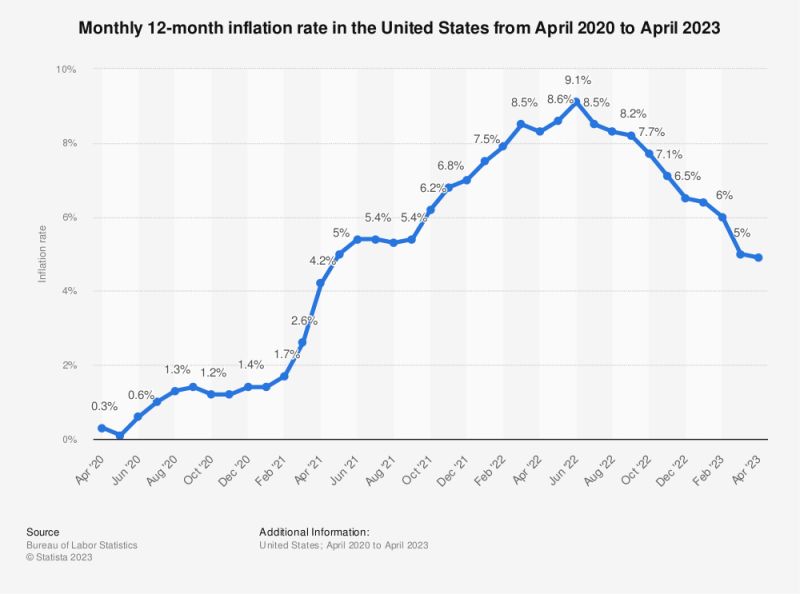

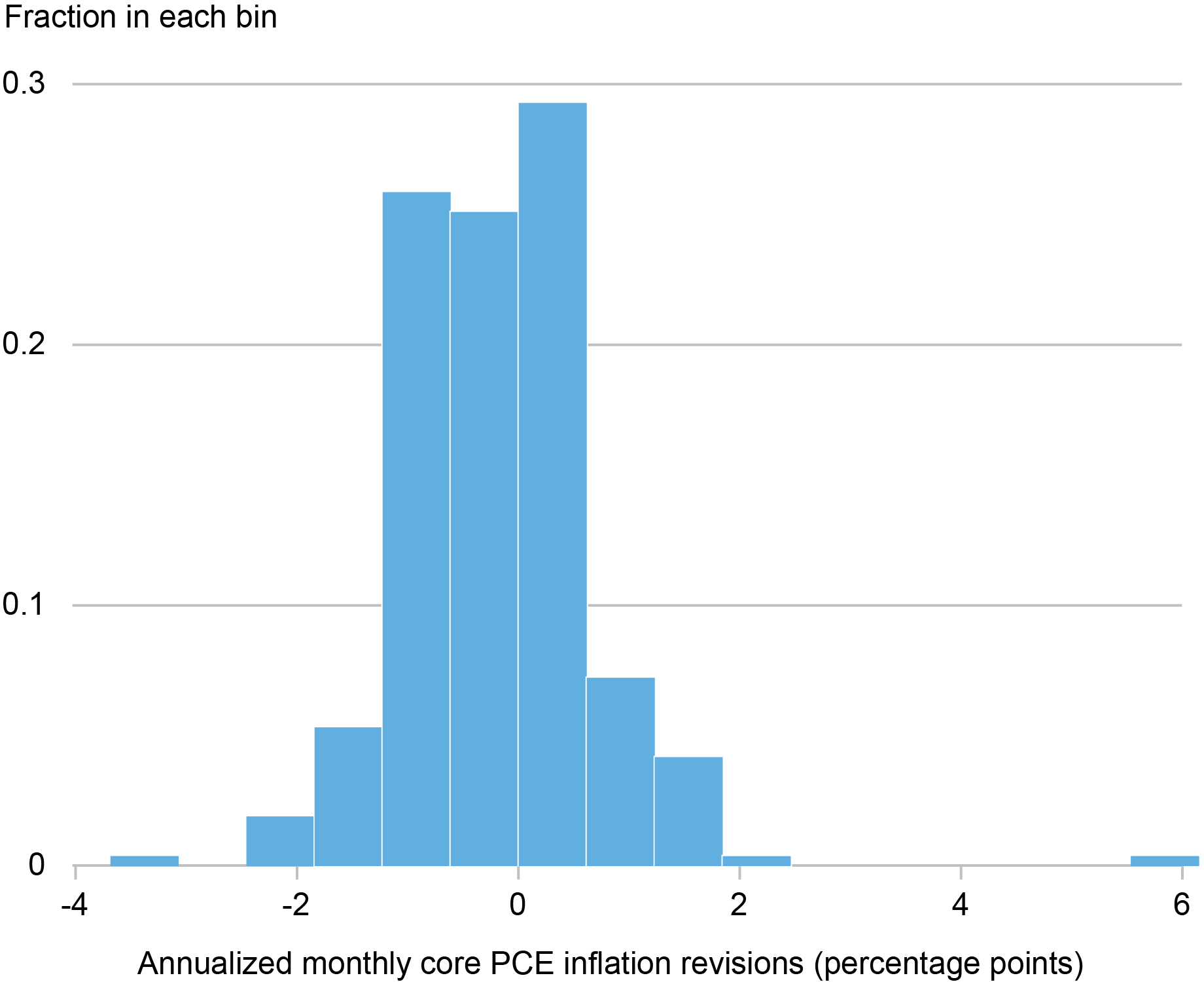

In today’s ever-changing economic landscape, understanding and analyzing inflation rates are crucial for businesses, policymakers, and individuals alike. Inflation can significantly impact purchasing power, interest rates, and overall economic stability. In this article, we will delve into the importance of inflation rate analysis and its implications for various stakeholders.

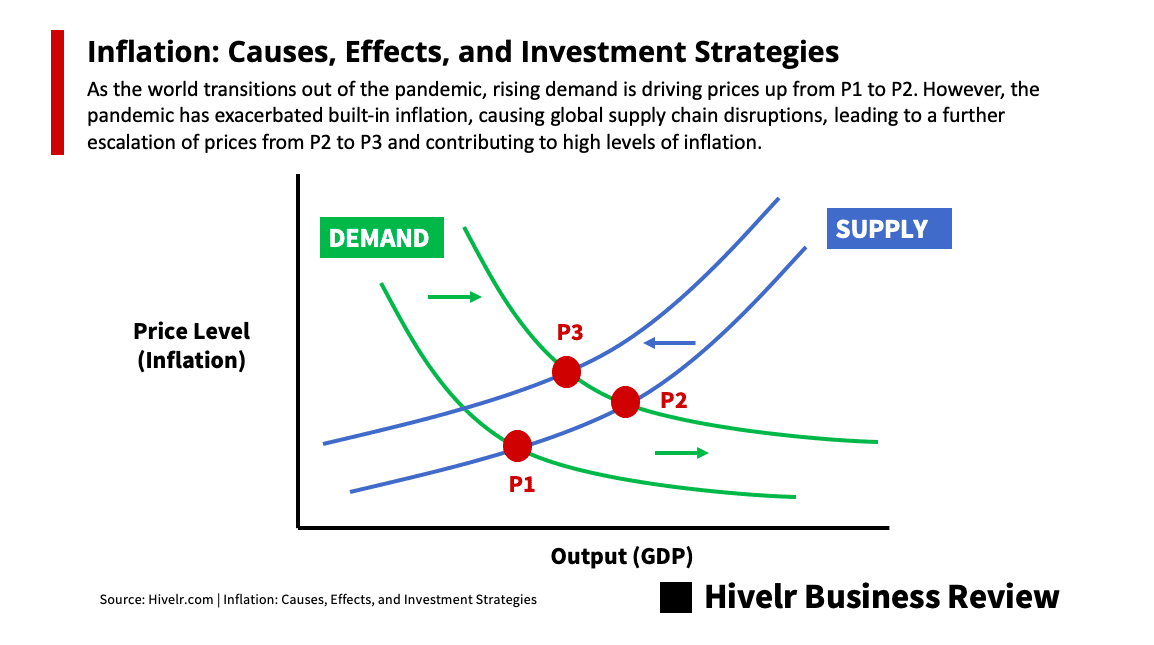

The Basics of Inflation

To begin our exploration, it’s essential to grasp the basics of inflation. Inflation refers to the rate at which the general level of prices for goods and services rises, leading to a decrease in purchasing power. Central banks and economists closely monitor inflation rates as they