Navigating Financial Realities: Economic Inflation Trends

Understanding economic inflation trends is paramount in navigating the complex landscape of financial markets. This article delves into the intricacies of inflation, exploring its definitions, causes, impacts, and strategies for individuals and businesses to adapt to evolving economic landscapes.

Defining Economic Inflation

Economic inflation refers to the sustained increase in the general price level of goods and services over a period. It is a key economic indicator that measures the decrease in the purchasing power of a currency. Inflation is often expressed as an annual percentage, reflecting the rate at which prices rise.

Causes of Inflation

Inflation can have various causes, each influencing the economy differently. Demand-pull inflation occurs when demand for goods and services outpaces their supply, leading to increased prices. Cost-push inflation, on the other hand, results from rising production costs, such as increased wages or higher raw material prices. Understanding these factors is crucial in deciphering inflation trends.

Impact on Consumers and Businesses

The impact of inflation is felt by both consumers and businesses. For consumers, inflation erodes purchasing power, meaning they need more money to maintain the same standard of living. Businesses, particularly those operating on thin profit margins, may face challenges as production costs rise, affecting pricing strategies and profitability.

Inflation Trends and Investment Strategies

Investors closely monitor inflation trends as they significantly impact investment strategies. Inflation erodes the real return on investments, especially on fixed-income assets like bonds. Investors often adjust their portfolios to include assets that historically perform well during inflationary periods, such as real estate or commodities.

Strategies for Individuals to Navigate Inflation

For individuals, navigating economic inflation trends requires strategic financial planning. Investing in assets that traditionally act as hedges against inflation, such as stocks or real estate, can help protect wealth. Additionally, maintaining a diversified portfolio and considering inflation-protected securities contribute to financial resilience.

Business Responses to Inflation

Businesses must adapt to inflationary pressures to remain competitive. This may involve adjusting pricing strategies, seeking cost efficiencies, and exploring alternative suppliers. Forward-thinking businesses also consider innovative approaches, such as investing in technology to improve efficiency and streamline operations amid inflationary challenges.

Central Bank Policies in Inflation Management

Central banks play a crucial role in managing inflation through monetary policies. Adjusting interest rates, conducting open market operations, and influencing money supply are tools used by central banks to maintain price stability. Striking the right balance is essential to avoid both inflationary pressures and deflationary risks.

Global Perspectives on Inflation

Inflation trends are not confined to national borders; they are part of the interconnected global economy. Events in one region can influence inflation rates worldwide. As economies become increasingly intertwined, understanding global perspectives on inflation is vital for businesses and investors navigating the international marketplace.

Anticipating Future Inflation Trends

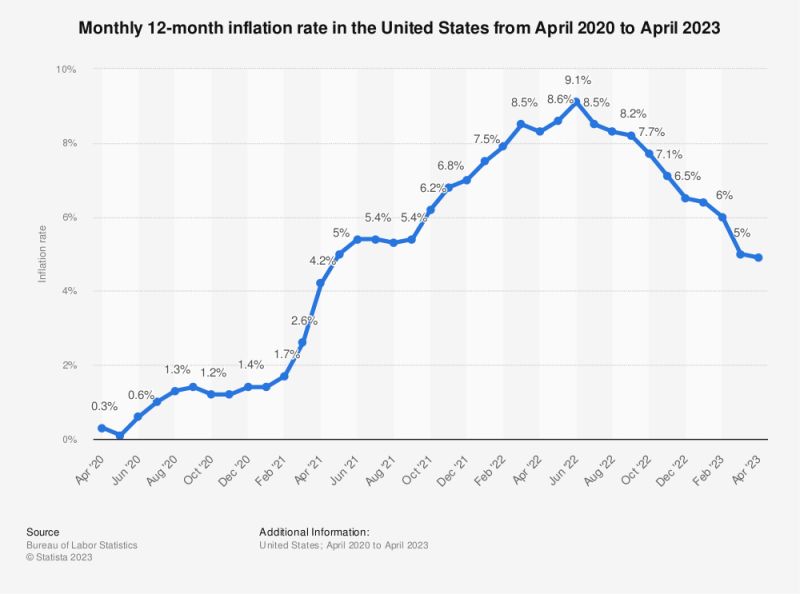

Anticipating future inflation trends involves analyzing a myriad of economic indicators. Monitoring factors like employment rates, wage growth, and commodity prices helps forecast potential inflationary pressures. While predicting inflation with absolute certainty is challenging, staying informed and adaptable is key to navigating economic uncertainties.

Building Resilience in a Dynamic Economic Landscape

In conclusion, economic inflation trends are dynamic and multifaceted, impacting individuals, businesses, and global markets. Building resilience in this dynamic landscape involves staying informed, diversifying investments, and adapting strategies to changing economic conditions. To explore more insights into economic inflation trends, visit Economic Inflation Trends for additional resources and analysis.