Inflation Outlook in Britain: Analyzing Economic Expectations

Economic stability is a paramount concern for any nation, and one of the key indicators reflecting this stability is the inflation rate. In the context of Britain, understanding and analyzing inflation expectations becomes crucial in predicting economic trends and shaping financial strategies.

The Significance of Inflation Expectations

Inflation expectations play a pivotal role in shaping economic behavior. Businesses, investors, and consumers all closely monitor these expectations as they influence decision-making processes. When inflation expectations are well-managed, they contribute to a stable economic environment, fostering investment and consumption.

Factors Influencing Inflation Expectations

Several factors contribute to shaping inflation expectations in Britain. Central to this is the monetary policy set by the Bank of England, which directly impacts interest rates and money supply. Additionally, global economic conditions, trade dynamics, and geopolitical events can exert pressure on inflation expectations.

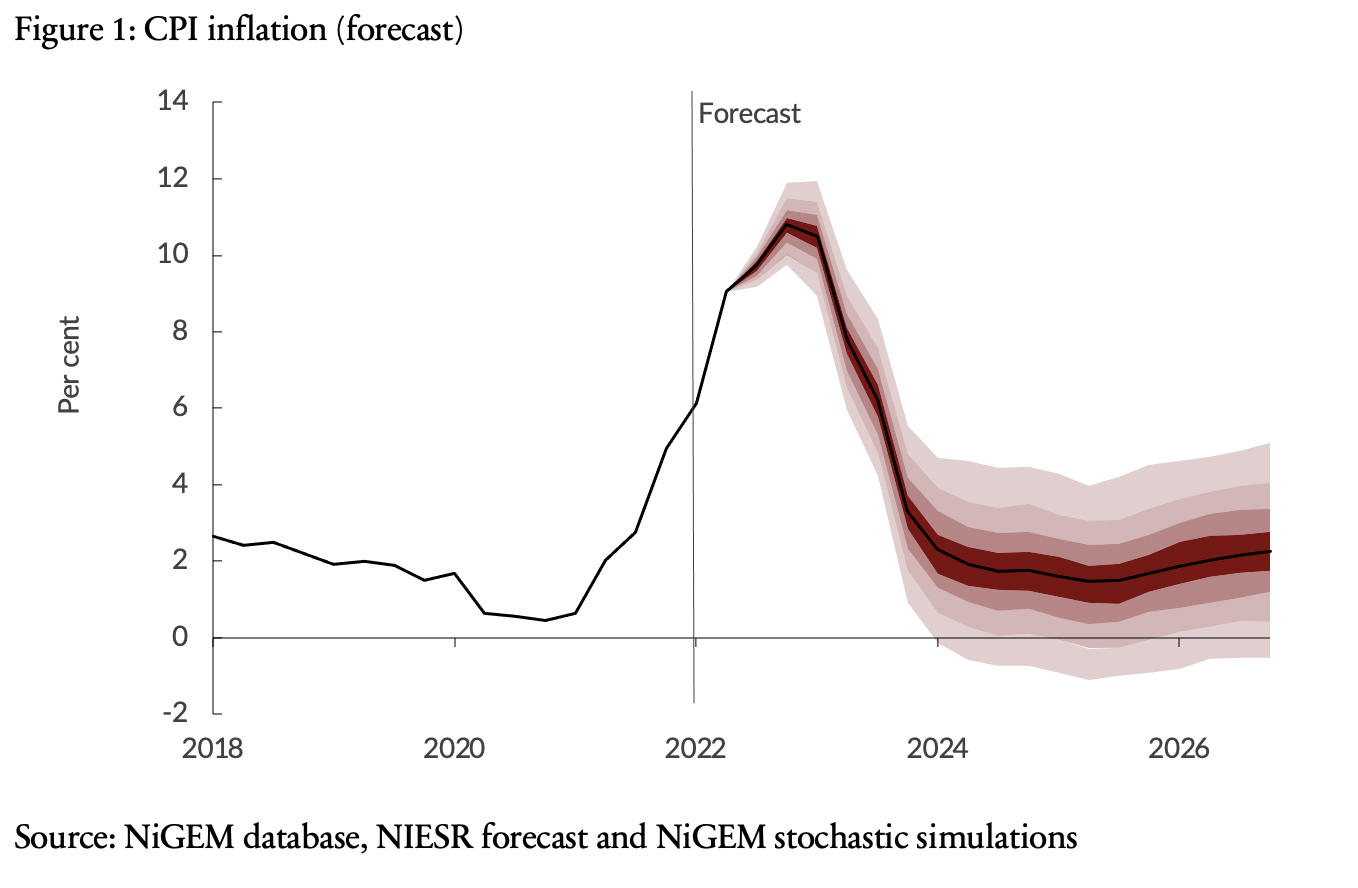

Historical Trends and Lessons Learned

Examining historical trends in inflation expectations provides valuable insights into the resilience of the British economy. Past periods of economic turbulence and recovery can offer lessons on how inflation expectations have responded to various stimuli, guiding policymakers in their decision-making processes.

The Role of Government and Central Bank

Effective communication and collaboration between the government and the central bank are crucial in managing inflation expectations. Transparent policies, clear communication, and timely interventions are essential tools to ensure that inflation remains within acceptable bounds, fostering economic stability.

Impact on Businesses and Investments

For businesses and investors, staying abreast of inflation expectations is imperative for making informed decisions. In an environment of stable inflation expectations, businesses can plan for the future with confidence, and investors can allocate resources more strategically.

Navigating Uncertain Times

In times of economic uncertainty, such as those posed by global events or financial crises, inflation expectations can be particularly volatile. Navigating through these uncertain times requires adaptive strategies, robust risk management, and a keen understanding of the broader economic landscape.

Inflation Expectations Britain: A Closer Look

To gain a more nuanced understanding of inflation expectations in Britain, it’s essential to delve into the specific data and indicators that experts use to assess the economic climate. The Inflation Expectations Britain platform provides a comprehensive analysis, offering real-time insights into market expectations, economic projections, and policy implications.

Looking Ahead

As we navigate the complexities of the global economy, keeping a close eye on inflation expectations in Britain is paramount. A proactive approach, grounded in data-driven insights and collaborative policymaking, will contribute to a resilient economic future.

In conclusion, understanding and managing inflation expectations are integral components of a robust economic strategy. By analyzing historical trends, considering influencing factors, and staying informed through platforms like Inflation Expectations Britain, stakeholders can contribute to a stable and prosperous economic landscape.