Evaluating US Inflation: Navigating Economic Outlook

Evaluating US Inflation: Navigating Economic Outlook

Understanding the current and future inflation outlook in the United States is essential for shaping economic strategies and making informed decisions. This article delves into the factors influencing inflation in the US and examines the economic outlook amid inflationary considerations.

Key Economic Indicators and Inflation Trends

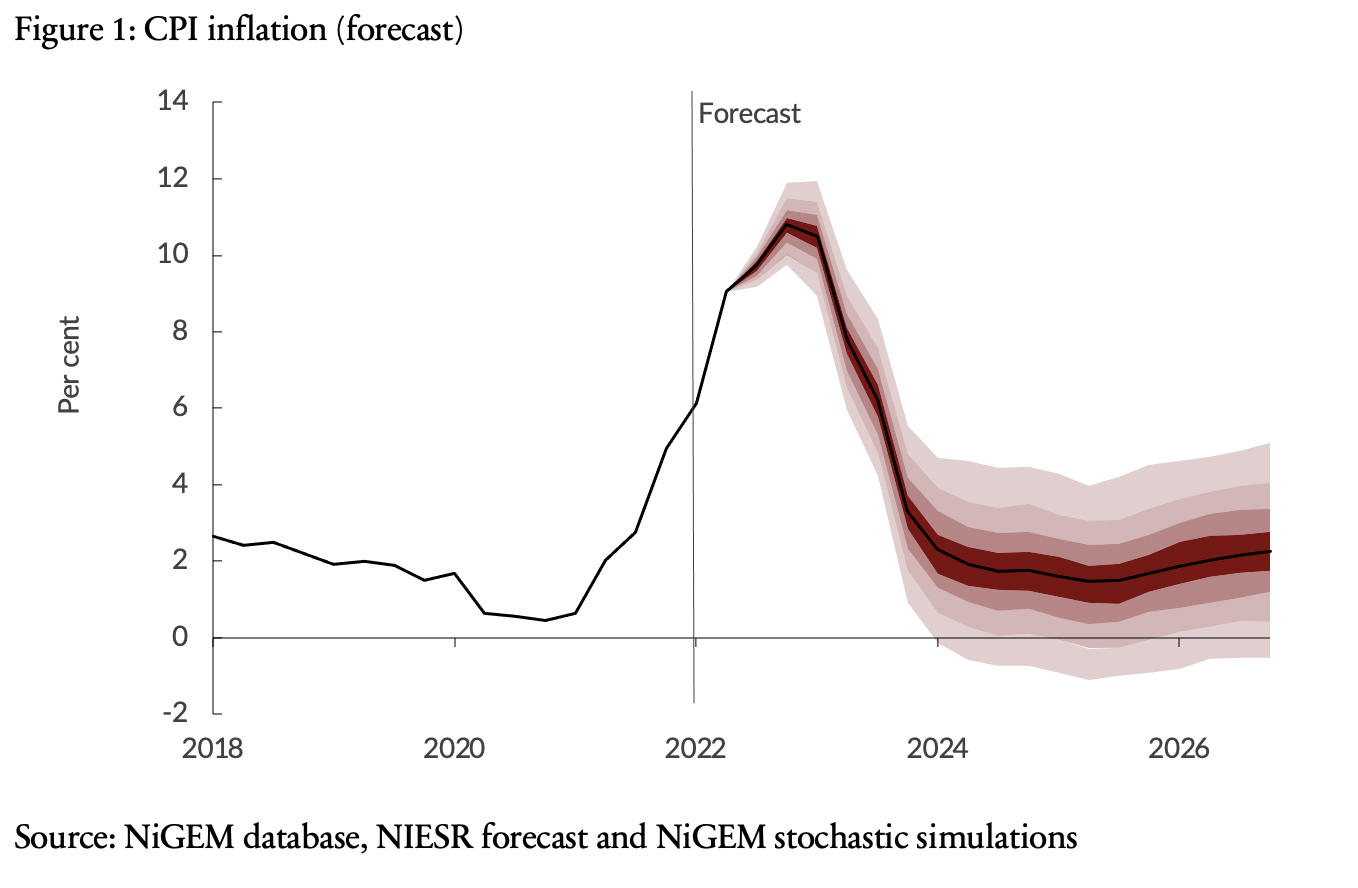

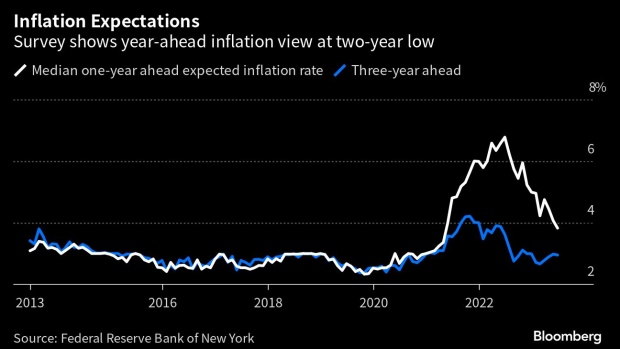

Analyzing key economic indicators provides valuable insights into inflation trends. Metrics such as the Consumer Price Index (CPI), Producer Price Index (PPI), and wage growth offer a comprehensive view of inflationary pressures. Monitoring these indicators helps gauge the direction of inflation and its potential impact on various sectors

:max_bytes(150000):strip_icc()/inflation_final-8652eb79d80348f49810849af466bb44.png)