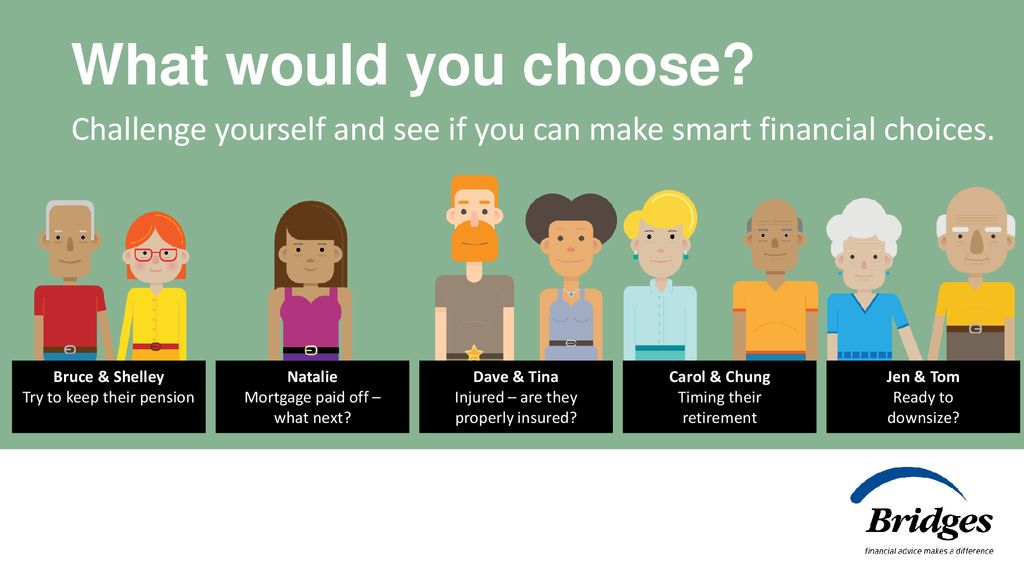

Smart Financial Choices: Navigating Wealth Wisely

Financial well-being is a journey guided by the choices we make. This article delves into the importance of smart financial choices, offering insights and strategies for navigating wealth wisely and securing a stable financial future.

Understanding the Power of Budgeting

At the core of smart financial choices lies the practice of budgeting. Creating a detailed budget allows individuals to track income, expenses, and savings goals. By understanding where money goes, one can make informed decisions to allocate resources effectively and prioritize financial objectives.

Building an Emergency Fund: Financial Safety Net

One of the smartest financial choices is establishing an emergency fund. This fund serves as a financial safety net, providing a cushion in times of unexpected expenses or income disruptions. A well-funded emergency fund ensures that individuals can navigate through challenging situations without compromising their long-term financial goals.

Investing for Long-Term Growth

Smart financial choices extend to investment decisions. Investing wisely involves understanding risk tolerance, diversifying portfolios, and focusing on long-term growth. Whether through stocks, bonds, or other investment vehicles, a well-thought-out investment strategy can contribute significantly to building wealth over time.

Debt Management Strategies

Effective debt management is a key aspect of making smart financial choices. This involves understanding the types of debt, prioritizing high-interest debts, and developing a repayment plan. By managing debt wisely, individuals can free up resources for saving and investing, ultimately contributing to financial stability.

Strategic Use of Credit

Credit can be a valuable financial tool when used strategically. Making smart choices with credit involves maintaining a good credit score, understanding interest rates, and using credit responsibly. By leveraging credit wisely, individuals can access opportunities such as favorable loan terms and credit card rewards.

Planning for Retirement: A Long-Term Perspective

Smart financial choices include planning for retirement from an early stage. Contributing to retirement accounts, understanding employer-sponsored plans, and considering long-term investment strategies are crucial elements. Starting early and consistently contributing to retirement savings can lead to a financially secure retirement.

Insurance: Safeguarding Financial Health

Securing appropriate insurance coverage is a prudent financial choice. This includes health insurance, life insurance, and other forms of coverage based on individual needs. Insurance acts as a safeguard, protecting financial health in the face of unforeseen events and ensuring that unexpected expenses are not financially devastating.

Education and Skill Investment

Investing in education and skill development is an intelligent financial choice with long-term benefits. Enhancing knowledge and acquiring valuable skills can open doors to better career opportunities and increased earning potential. This strategic investment in oneself contributes to overall financial well-being.

Estate Planning: Preserving Wealth for Generations

Smart financial choices extend beyond individual wealth to the preservation of assets for future generations. Estate planning involves creating a will, establishing trusts, and making arrangements for the transfer of wealth. Thoughtful estate planning ensures that accumulated wealth benefits heirs and aligns with individual wishes.

Continuous Financial Education

Remaining informed and continuously educating oneself about financial matters is a cornerstone of smart financial choices. Staying abreast of economic trends, investment opportunities, and evolving financial strategies empowers individuals to make informed decisions and adapt to changing financial landscapes.

To learn more about Smart Financial Choices, explore the provided link. Embrace the journey of financial well-being by making informed choices and navigating wealth wisely.