Smart Financial Choices: Navigating Wealth Wisely

Smart Financial Choices: Navigating Wealth Wisely

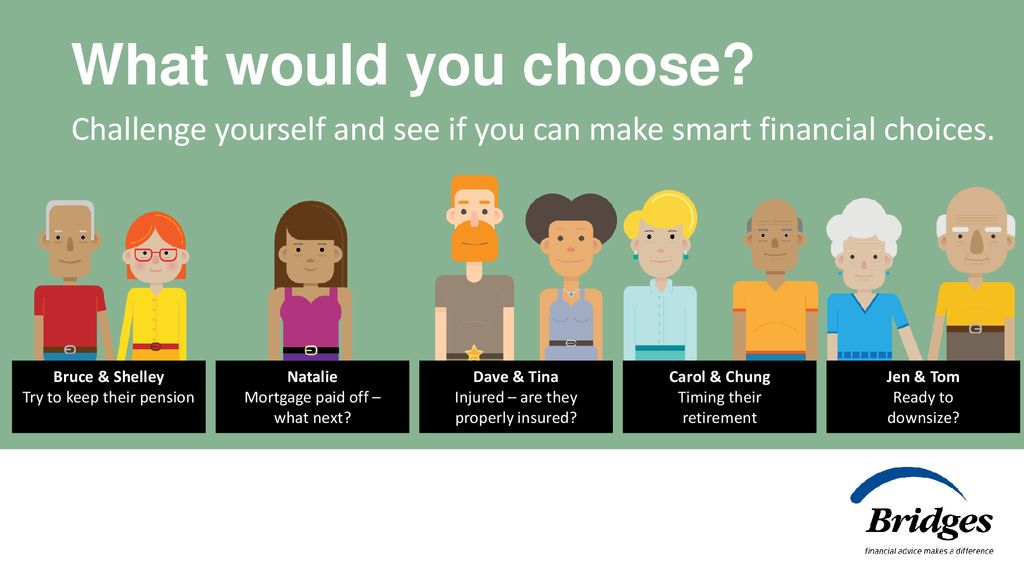

Financial well-being is a journey guided by the choices we make. This article delves into the importance of smart financial choices, offering insights and strategies for navigating wealth wisely and securing a stable financial future.

Understanding the Power of Budgeting

At the core of smart financial choices lies the practice of budgeting. Creating a detailed budget allows individuals to track income, expenses, and savings goals. By understanding where money goes, one can make informed decisions to allocate resources effectively and prioritize financial objectives.

Building an Emergency Fund: Financial Safety Net

One of the smartest