Navigating Financial Setbacks: Trends and Strategies for Resilience

Financial setbacks are an inevitable part of life, and understanding the trends shaping these challenges is crucial for developing effective strategies to navigate them. This article explores common trends in financial setbacks and provides insights into resilient strategies individuals can adopt.

Economic Uncertainties and Global Events:

The global economy is susceptible to uncertainties influenced by various factors, including geopolitical events, economic policies, and public health crises. Understanding the impact of these global events on personal finances is essential for anticipating potential financial setbacks and preparing accordingly.

Job Insecurity and Employment Trends:

Job insecurity is a prevalent trend in the modern workforce. Rapid technological advancements, shifts in industry demands, and unforeseen disruptions can lead to job instability. Individuals must stay vigilant about employment trends, upskill when necessary, and cultivate a mindset of adaptability to mitigate the impact of job-related financial setbacks.

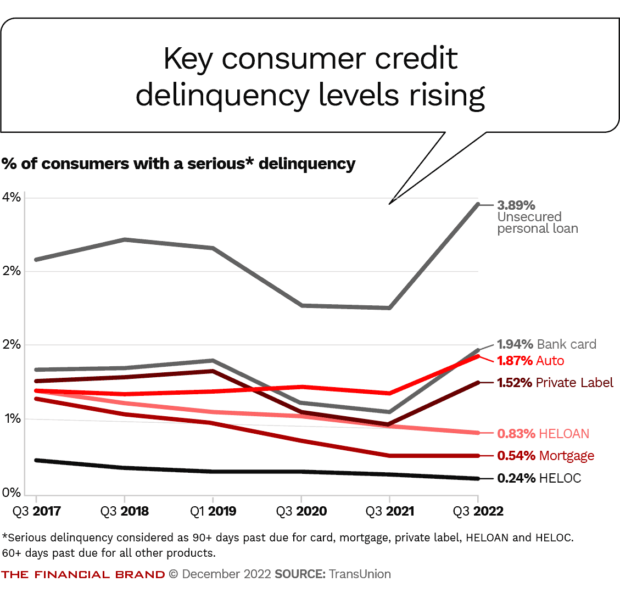

Debt Accumulation and Credit Challenges:

Accumulating debt is a common financial challenge that individuals face. High-interest debts, such as credit cards and loans, can lead to financial strain. Understanding responsible borrowing, managing debt effectively, and addressing credit challenges are crucial components of avoiding or recovering from financial setbacks related to indebtedness.

Market Volatility and Investment Risks:

Investing is inherently associated with risks, and market volatility can lead to fluctuations in the value of investment portfolios. Staying informed about market trends, diversifying investments, and adopting a long-term perspective are strategies to navigate financial setbacks arising from market uncertainties.

Healthcare Costs and Insurance Considerations:

Rising healthcare costs can contribute significantly to financial setbacks. Having adequate health insurance coverage, understanding policy details, and proactively managing healthcare expenses can help individuals mitigate the financial impact of unexpected medical challenges.

Housing Market Fluctuations and Real Estate Challenges:

Real estate trends, including housing market fluctuations, impact personal finances. Property values, mortgage rates, and housing market conditions can influence financial stability. Being informed about real estate trends and making informed decisions regarding homeownership can help individuals weather potential financial setbacks in this area.

Technological Advancements and Cybersecurity Risks:

As technology advances, so do the associated risks. Cybersecurity threats, identity theft, and online fraud can lead to significant financial setbacks. Implementing robust cybersecurity measures, staying vigilant about online activities, and safeguarding personal information are essential in addressing this modern financial challenge.

Education Costs and Student Loan Pressures:

The cost of education, coupled with the burden of student loans, is a prevalent trend affecting many individuals. Planning for education expenses, exploring scholarship opportunities, and managing student loans responsibly are key strategies to address financial setbacks related to education costs.

Unexpected Life Events and Emergency Preparedness:

Life is unpredictable, and unexpected events such as natural disasters, accidents, or family emergencies can result in financial setbacks. Establishing emergency funds, having appropriate insurance coverage, and creating contingency plans are vital for navigating the financial implications of unforeseen life events.

Personal Financial Management and Budgeting Strategies:

Effective personal financial management is a cornerstone of resilience against setbacks. Establishing and adhering to a budget, prioritizing savings, and regularly reviewing financial goals contribute to a proactive approach in managing personal finances and mitigating potential setbacks.

In conclusion, understanding the trends that contribute to financial setbacks is the first step toward building resilience. By staying informed, adopting proactive financial strategies, and cultivating adaptability, individuals can navigate the complexities of personal finance and emerge stronger from unexpected challenges. To explore more insights on Financial Setback Trends, visit this link for additional information and resources.