Navigating Financial Wellness through Smart Spending Decisions

Wise spending choices are fundamental to achieving financial wellness, providing individuals with the tools to secure their financial future. In this exploration, we delve into the importance of making prudent spending decisions and the impact they can have on personal and economic well-being.

The Foundations of Financial Wisdom

At the core of wise spending is a foundation built on financial literacy. Understanding budgeting, distinguishing between needs and wants, and having a clear overview of one’s financial situation are the pillars of making informed spending choices. Financial education empowers individuals to navigate their financial journey with confidence.

Budgeting as a Guiding Principle

Creating and sticking to a budget is a fundamental step in making wise spending choices. A well-structured budget provides a roadmap for allocating income to various expenses, savings, and investments. It serves as a guiding principle, helping individuals prioritize and control their spending to align with their financial goals.

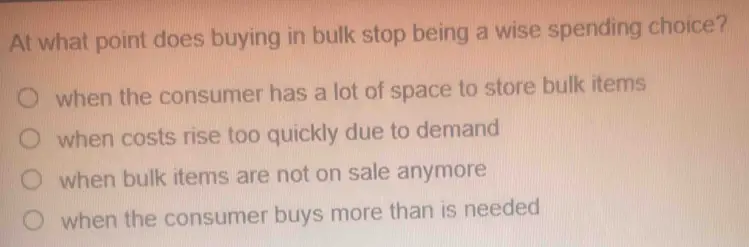

Prioritizing Needs over Wants

Distinguishing between needs and wants is a critical aspect of making wise spending choices. While indulging in occasional luxuries is acceptable, prioritizing essential needs ensures financial stability. Understanding the difference allows individuals to allocate resources where they matter most, avoiding unnecessary debt and fostering long-term financial health.

Building an Emergency Fund for Stability

One of the wisest spending choices is the establishment of an emergency fund. Unforeseen circumstances such as medical emergencies or sudden job loss can disrupt financial stability. An emergency fund acts as a financial safety net, providing peace of mind and preventing the need to rely on high-interest debt during challenging times.

Avoiding Impulse Purchases

Impulse purchases can derail even the most carefully crafted budgets. Making wise spending choices involves resisting the urge to make unplanned purchases. Developing mindfulness about spending habits, utilizing shopping lists, and taking time to evaluate the necessity of a purchase are effective strategies in curbing impulsive spending.

Harnessing Technology for Financial Control

In the digital age, technology offers valuable tools for managing finances. Utilizing budgeting apps, expense trackers, and online banking services provides real-time insights into spending patterns. Technology becomes an ally in making wise spending choices, offering convenience and transparency in financial management.

Evaluating Long-Term Value

Wise spending extends beyond immediate gratification to considering the long-term value of purchases. Investments in education, health, and quality assets contribute to long-term well-being. Viewing spending decisions through a lens of long-term value ensures that resources are directed towards endeavors that yield enduring benefits.

The Role of Comparative Shopping

Comparative shopping is a practical strategy in making wise spending choices. Whether purchasing goods or services, exploring different options allows individuals to find the best value for their money. Harnessing the power of competition ensures that spending aligns with quality and affordability.

Eliminating High-Interest Debt

A prudent financial strategy involves eliminating high-interest debt. Prioritizing the repayment of debts with high-interest rates frees up financial resources that can be redirected towards savings and investments. This strategic move accelerates the journey towards financial freedom.

Fostering a Mindset of Financial Responsibility

Beyond specific strategies, wise spending choices are rooted in cultivating a mindset of financial responsibility. This involves an ongoing commitment to learning, adapting to changing circumstances, and being proactive in managing finances. A responsible financial mindset is the cornerstone of sustainable financial well-being.

In the pursuit of financial wellness, making wise spending choices is a transformative journey. Explore Wise Spending Choices for ongoing insights and tips on navigating the path to financial prosperity.