Smart Spending Decisions: Navigating Financial Wisdom

Navigating Financial Wellness through Smart Spending Decisions

Wise spending choices are fundamental to achieving financial wellness, providing individuals with the tools to secure their financial future. In this exploration, we delve into the importance of making prudent spending decisions and the impact they can have on personal and economic well-being.

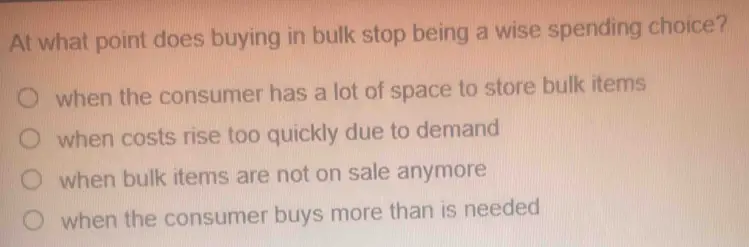

The Foundations of Financial Wisdom

At the core of wise spending is a foundation built on financial literacy. Understanding budgeting, distinguishing between needs and wants, and having a clear overview of one’s financial situation are the pillars of making informed spending choices. Financial education empowers individuals to navigate their financial