Family Budgeting Wisdom: Financial Well-Being for All

Managing a family budget is an essential skill that contributes to financial stability and overall well-being. This article delves into the principles of family budgeting wisdom, offering practical insights, strategies, and tips to help families navigate their finances and achieve lasting financial health.

The Foundation of Financial Literacy:

At the core of family budgeting wisdom is financial literacy. Understanding basic financial concepts, such as income, expenses, savings, and investments, lays the foundation for effective budgeting. Families equipped with financial literacy are better positioned to make informed decisions and build a solid financial future.

Setting Clear Financial Goals:

Every successful family budget begins with setting clear financial goals. Whether it’s saving for education, a home, emergencies, or retirement, establishing specific and realistic goals provides a roadmap for effective budgeting. These goals serve as motivators, guiding financial decisions and priorities.

Creating a Comprehensive Budget:

A family budget should encompass all income sources and expenses, providing a comprehensive overview of the household’s financial landscape. Categorizing expenses into fixed and variable helps identify areas where adjustments can be made. Creating a detailed budget fosters transparency and accountability in financial matters.

Prioritizing Essential Expenses:

In family budgeting wisdom, prioritizing essential expenses is paramount. Basic needs such as housing, utilities, groceries, and healthcare should take precedence. Allocating a significant portion of the budget to these essentials ensures that the family’s fundamental needs are met before discretionary spending.

Emergency Fund: A Financial Safety Net:

An emergency fund is a key component of family budgeting wisdom. Setting aside a portion of income for unexpected expenses provides a financial safety net. This fund prevents the need to dip into long-term savings or incur debt during unforeseen circumstances, offering peace of mind and financial resilience.

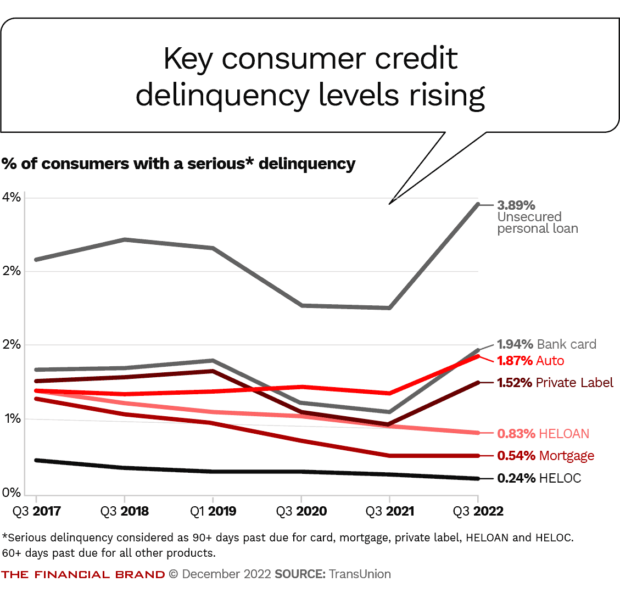

Debt Management Strategies:

Addressing and managing debt is crucial for maintaining financial well-being. Family budgeting wisdom includes strategies for debt repayment, such as the snowball or avalanche methods. Minimizing high-interest debt and making consistent payments contribute to long-term financial health.

Saving for the Future:

Beyond immediate needs, family budgeting wisdom emphasizes saving for the future. This includes contributions to retirement accounts, investments, and long-term savings goals. Compound interest and disciplined saving habits empower families to build wealth and secure a comfortable future.

Smart Spending and Frugality:

Practicing smart spending involves making conscious choices about purchases. Family budgeting wisdom encourages frugality, finding ways to cut unnecessary expenses without sacrificing quality of life. This can include meal planning, embracing second-hand options, and being mindful of non-essential spending.

Regularly Reviewing and Adjusting:

A static budget may not align with changing circumstances. Family budgeting wisdom involves regularly reviewing and adjusting the budget as needed. Life events, income changes, and evolving financial goals require a flexible budgeting approach to ensure continued effectiveness.

Financial Education for All Family Members:

Instilling financial wisdom in all family members is a cornerstone of family budgeting success. Educating children about money management, saving, and responsible spending sets the stage for their financial literacy and well-being in the future. Open discussions about finances contribute to a financially savvy family.

Family Budgeting Wisdom: A Path to Financial Well-Being:

In conclusion, family budgeting wisdom is a holistic approach to financial well-being that empowers families to manage their finances effectively. By incorporating financial literacy, goal setting, prudent spending, and regular reviews, families can navigate their financial journey with confidence. Explore more about Family Budgeting Wisdom to gain valuable insights and resources for your family’s financial success.